FTSE4Good Index

Good governance is vital to ensure effective management of a company, improve

its reputation, and maintain the confidence of the financial markets.

Good governance is vital to ensure effective management of a company, improve

its reputation, and maintain the confidence of the financial markets.

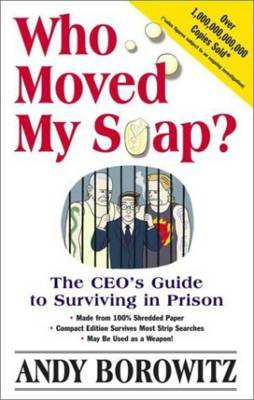

Williams has consistently maintained his innocence but made a

brief appearance in court yesterday to plead guilty to criminal charges of

misleading and "reckless" corporate behaviour.He now faces up to 12 years' jail for his role in the

country's biggest corporate failure.

A city boy, Kenny, moved to the country and bought a donkey from an old farmer for $100.00. The farmer agreed to deliver the donkey the next day.The next day the farmer drove up and said, "Sorry son, but I have some bad news, the donkey died." Kenny replied, "Well then, just give me my money back."The farmer said, "Can't do that. I went and spent it already."Kenny said, "OK then, just unload the donkey."The farmer asked, "What ya gonna do with him?" "I'm going to raffle him off.""You can't raffle off a dead donkey!" the farmer said."Sure I can. Watch me. I just won't tell anybody he is dead."A month later the farmer met up with Kenny and asked, "What happened with that dead donkey?"Kenny said, "I raffled him off. I sold 500 tickets at two dollars apiece and made a profit of $898.00." "Didn't anyone complain?" "Just the guy who won. So I gave him his two dollars back."

Euh ... I have to apologize for the typos and grammar errors I let through in my previous posts. I hadn't exactly proof-read everything.

Now's test time. Who in the banking and financial services industry get richest quickest?

Well, it seems the Hedge Fund Managers get wealthier faster than other banking & financial services professionals. Hardly a surprise when you consider what a hedge fund is:

A fund usually used by wealthy investors or institutions (because of legal restrictions) which uses aggressive, techniques including selling short, leverage, program trading, swaps, arbitrage and derivatives to offset or reduce the risk associated with an existing investment or group of investments. The keyword here is "aggressive".

Now don't get fooled by the name! Some of these funds do not actually hedge against risk (Hedging being the attempt to reduce risk). In fact, there are different styles of hedge funds who pursue different investment strategies in terms of returns volatility and risk. These funds are called "Hedge Funds" maybe because they are often used by investors as a means to diversify away some risk in a particular portfolio. Or the name prevailed because despite controversy surrounding the $US1 trillion industry , most of these funds do seek to reduce risk.

"Yeah. So what's the problem then?" you will ask. This sounds very much like a mutual fund with a little more liberty to meet investors demands. Well, not exactly.

Continues ...

A few weeks ago at work we did a function for JB Were. I wasn't working on that night, thank God. One of my lecturer was there I heard. One tough guy (or at least he wanted us to think so). He did a good job of setting a high standard for the course. He gave us the single hardest assignment I ever had at uni. But I am still very disappointed by his class. It was representative of my whole degree in a way.

I made it through university, learned a great deal about market mechanisms and finance theory. We were fed tons of research papers on CAPM and alternative asset pricing models (you know, multifactor models and all). We were taught Black-Scholes option pricing model. All this based on so many assumptions that at first I thought it was a joke. Ah, and the Efficient Market Hypothesis (EMH). Great stuff too.

But we were rarely told the reality of the Market. We only brushed the idea that actual models are flawed because the assumptions upon which they are based are violated every day. Many of the models we studied are to varying extent reliant on or derived from the CAPM. Now recall some of model's assumptions:

Great stuff. But until now, I am convinced that investors have a tendency to over and under-react to information released. Wait, not only do they over-react but their decisions are affected by non-economic factors (or remotely economically relevant factors). In my opinion, this isn't just a few rogue investors and speculators but rather the large majority of market participants.

Continues ...

The argument here isn't that economic data is not factored into securities prices. Because it is. However, information with little or remote economic consequence is overweighted in investors' decisions.

Look, maybe the collective mind that is the market actually has moods. And because geopolitical elements have such an impact of the Market one could almost predict future events by gauging the mass of all investors’ sentiment. How about that? Yes, I know: it’s a stretch. But wait, wait. Before you dismiss this whole post as ridiculous add a touch of inside information that circulates in certain classes of investors. The Pentagon thought it was a good theory.

They came up with “Terrorism Futures” to help predict terrorist strikes. The scheme was aborted a day after the proposal was made public. The Policy Analysis Market (PAM) program would allow individuals to invest money on the probability of terrorist attacks. No wonder it was a short-lived plan. Can you imagine adding Terrorism Futures to your portfolio? That's certainly volatile material. Speculators and gamblers would have loved it. But the Senate wasn't impressed. It is a very sinister idea; particularly coming from a government agency.

Now putting the moral issue aside, I can't help admiring the initiative. They went to the trouble of elaborating a trading program for the grotesquely-named scheme. It was a good idea. Actually, I should say it would have been an interesting experiment. The results could have proved something about investors behaviour. Indeed the fact that they seriously considered implementing such a plan demonstrates that the Market is thought to capable of sensing or foreseeing major events.

Do you think the Market sensed 9/11 attacks?

I know. This is rather sinister but it shows that there is much more at work than Beta, risk free rate and market return. University could have done more to develop student critical view of finance.

How is China going to fix its Non-Performing Loans problem before it comes in direct conflict with the liberalisation reforms?

China's WTO membership was bundled with a host of market access measures to be implemented. The package-deal require the country to open-up to foreign investment sectors of the economy dominated by SOEs. Privatisation: the ticket to free markets and economic prosperity.

Only the level of Non-Performing Loans of the SOEs and the banks worked to keep risk-adverse investors away from Chinese heavy industries (together with the CCP's reluctence to privatise pillar industries).

Now, foreign investors have so much confidence that the Chinese miracle is not a mirage that they start buying the country's NPLs! Two years ago I would have never thought that anyone would spend a penny purchasing loans that probably won't be repaid. Worst, I never thought that Chinese Central power would allow this to happen.

Now I am confused. I was first puzzled when Patricia Cheng, from the Sydney Morning Herald wrote:

"Foreigners want China's bad debts"

Why would this be? I mean there clearly is an investment opportunity here but the risks associated with it should be a major discouragement for foreign investors. At least it ought to be the case if we are talking about a few institutions buying large chunks of the Chinese banks and Asset MAngement Companies (ACMs). No? The CCP has far too much influence on the approval process for this to worth the risk. And at what discount rate? 7%? Come on.

But as I read William Pesek Jr's column for Bloomberg News I understood why Citigroup, Goldman Sachs and Morgan Stanley have bought more than $US4 billion of distressed assets. The column is titled "The Next Great China Gold Rush -- Dodgy Debt". "Gold Rush" captures quite well the nature of the phenomenon, in my opinion. Pesek writes this:

"[...] investors are scrambling to get in on the next Chinese gold rush: More than $450 billion of bad loans held by China's four-biggest commercial banks and their asset management companies. The hope is to buy dodgy loans at a fraction of

their face value and sell the assets at a profit as the world's fastest-growing

major economy expands."

But what about transparency? The Chinese government is not exctly the most transparent when it comes to its crippled banking sector.

There are also reports that the Government issued rules to facilitate the sale of bad loans to foreigners? Despite what credit rating agencies say (that this sale of bad loans is going much too slow) I still think no one should rush. Let's not make this another disaster 98-Asian Crisis style where everyone runs in because the saw that big boys go. Looking at the fundamental picture, China still is largely, if not entirely, underdevelopped in terms of its financial sector's infrastructures and framework. It is maybe too early to literally "rush in".

Recall that crony capitalism still runs wild in the ranks of Chinese officials and business people. Quick sale of Non performing loans is a good way from many to get out of trouble rich.

Anyway, I am just a grad. Maybe I'll understand the situation better later.

These days I am doing a bit of research on Corporate risk management. You know? Hedge funds and all. Well, there too I think wierd things happen. I'll keep you posted.

"Directed $25 million anal shipping and receiving operations." Either this person is showcasing compulsively stubborn management qualities, or he has a challenging product packaging/storage problem.

"Experienced supervisor, defective with both rookies and seasoned professionals." Many of us have had a boss like this at some point in our careers, but you usually don't find them being so up-front about their leadership inadequacies.

"Consistently tanked as top sales producer for new accounts." Sales managers aren't likely to be impressed with this self-proclaimed underachiever.

"Dramatically increased exiting account base, achieving new company record." If customer accounts were leaving in droves as this statement implies, it's probably fair to assume that this candidate also tanked as a top sales producer.

"Internship at a growing, reputable company bent on world domination, or similarly grand aspirations. Preferably in a business-oriented role, while working near the latest and greatest technology.

A friendly environment, with crazy ideas and having fun being the norm. Ideally

located somewhere with warm, gentle ocean-front weather. "