The J.O.B Market and Extravagant CEOs

And back for anther year. It isn't exactly starting the way I wished: I didn't get any reply from the positions I applied for prior to the Christmas holidays.

But that's ok. I am still in an optimistic mood. I mean, with the current shortage of accountants employers are more flexible when selecting candidate. Hay Accounting & Finance reported that employers prefer to "match personality and cultural fit rather than solely technical skills, when assessing potential employees".

That's good news because the competition is intense between accountancy job-seekers (and employers). Employers want to make sure they get the best candidates. The Acountancy Employment Activity Report (by Hays Accounting & Finance) concludes on an optimistic note for job-seekers:

With counter offers rising as a severe shortage of candidates continues, staff retention has become an important issue. We expect vacancy levels to grow as the healthy labour market continues. [...] Strong market confidence and continuing secondments of staff to Sarbanes-Oxley and IFRS project work will also create backfill temporary vacancies. Overall, activity should be strong as market confidence remains high and employers continue to expand staffing levels. As such, the next quarter [July- September 2004] should provide fascinating times for candidates and employers alike.

And it was! See for yourself! Check the July - September 04 Accountancy Employment Activity Report.

I hope this month will bring me good responses. We shall see.

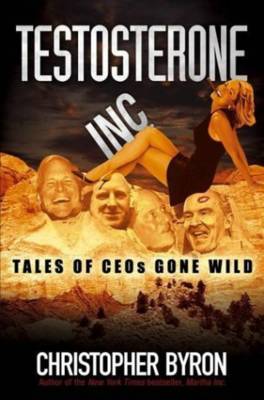

Meanwhile here is one very cool book you can buy yourself on amazon.com. It looks to me like good summer reading.

CEOs Gone Wild?

Note: We'll discuss the issue of corporate governance another day. But for now let me clarify one thing. I have no problem with executives who receive (or pay themselves) fat cheques. I hope to be one of them one day ;) .

However, they should land big bonuses and perks only when they create maximum value for the shareholders. Definitely not when the company goes bust. It is a lot like the risk-return principle. Think about it: executives get compensated for the risk they take. That is the risk of being held liable if things go sour. High risk, high return.

We will talk about this is in a more constructive way another day. Until then take care.